By analyzing DOL, stakeholders can better anticipate the impacts of sales fluctuations on a company’s profitability. A company with high financial leverage is riskier because it can struggle to make interest payments if sales fall. This variation of one time or six-time (the above example) is known as degree of operating leverage (DOL). Finally the calculator uses the formulas above to calculate the DOL and the operating leverage for each business. Let us take the example of Company A, which has clocked sales of $800,000 in year one, which further increased to $1,000,000 in year two.

What is Degree of Operating Leverage – Its Formula, Calculation and What Does It Measure

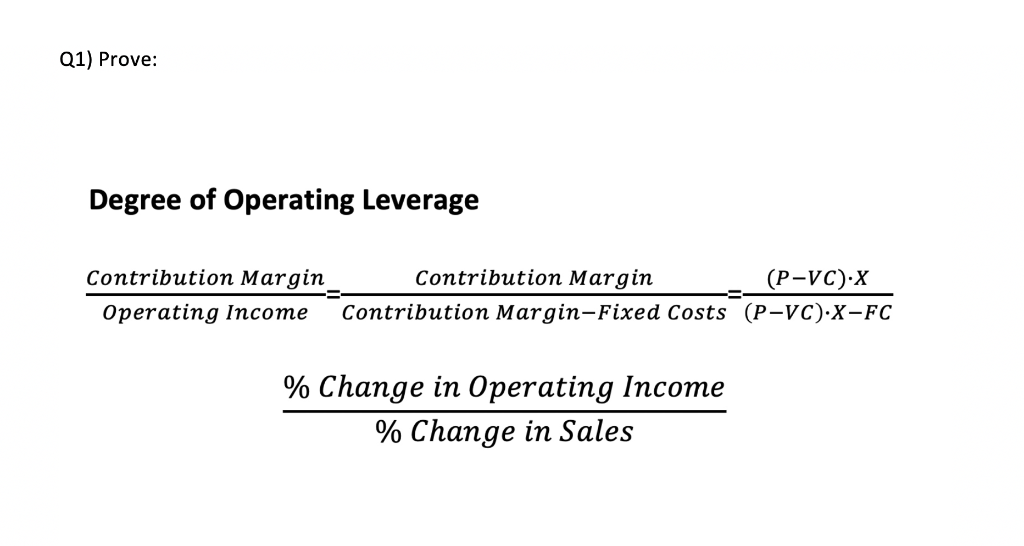

The Degree of Operating Leverage (DOL) calculator helps you understand the proportionate change in operating income as a result of a change in sales. This is useful for analyzing the risk and potential return of investing in a business. The DOL essentially measures how sensitive a company’s operating income is to fluctuations in its sales volume. The higher the DOL, the more a company’s operating income will be affected by changes in sales. Companies with a low DOL have a higher proportion of variable costs that depend on the number of unit sales for the specific period while having fewer fixed costs each month.

How Can This Metric Help You Make Better Decisions?

If you have the percentual change (period to period) of sales, put it here. Otherwise, add the specific period data in the section “Period to period specific data” above. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- A company with a high DOL can see huge changes in profits with a relatively smaller change in sales.

- Read on to learn how to calculate DOL and how different it is from financial leverage.

- Conversely, retail stores tend to have low fixed costs and large variable costs, especially for merchandise.

- Use the calculator to pinpoint cost control opportunities and streamline your operations.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- A higher DOL suggests that any price changes will have a magnified effect on your profits.

Operating Leverage Formula

In the world of finance, the Degree of Operating Leverage is a key metric for assessing a company’s financial resilience and profit potential. If a company has high operating leverage, then it means that a large proportion of its overall cost structure is due to fixed costs. Such a company will enjoy huge changes in profits with a relatively smaller increase in sales. On the other hand, if a company has low operating leverage, then it means that variable costs contribute a large proportion of its overall cost structure.

Part 2: Your Current Nest Egg

In most cases, you will have the percentage change of sales and EBIT directly. The company usually provides those values on the quarterly and yearly earnings calls. Basically, you can just put the indicated percentage in our degree of operating leverage calculator, even while the presenter is still talking, and voilà. For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability.

The Degree of Operating Leverage is also important for an investor, as it can indicate the risk of an investment and illustrates the performance of a company. Read on to learn how to calculate DOL and how different filing and payment deadlines questions and answers it is from financial leverage. Yes, DOL can be used to compare the operational risk of companies within the same industry, helping investors identify firms with higher or lower financial risk profiles.

It provides insight into the relationship between fixed and variable costs and their impact on profitability. High DOL indicates that a small percentage change in sales can lead to a significant change in operating income. The Degree of Operating Leverage (DOL) is a financial ratio measuring the change in the operating income of a company to a change in sales. Companies or firms with a large proportion of variable costs to fixed costs have higher degrees of operating leverage and vice versa. A low DOL, on the other hand, suggests that a company’s variable costs are higher than its fixed costs. This means that changes in sales have a less dramatic impact on operating income.

Finally, it is essential to have a broad understanding of the business and its financial performance. That’s why we highly recommend you check out our otherfinancial calculators. We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two.